Frequently Asked Questions

You will find the question and answer:

National projects

Prepare and submit an application

General

In the case of innovation projects with implementation partners, there is no limit to the project duration. As a rule, they run for between 6 and 36 months.

In the case of innovation projects without an implementation partner, a project may run a maximum of 18 months.

In justified cases, the duration may be extended in accordance with the requirements of Article 6(2)(c) of the implementing provisions for innovation projects:

There is no financial ceiling for applications for contributions to innovation projects of research partners with or without an implementation partner, provided it makes sense for your innovation project and the cost-benefit ratio is right.

However, in the case of innovation projects with an implementation partner, the latter must be prepared to pay 40-60 per cent of the total project costs themselves. This applies to all subject areas.

Since this institution cannot yet be selected in the Innosuisse application plateform for applications involving new research partners, and no hourly rates for staff have been stored for these applications yet, the research partner must first get in touch with innoprojects@innosuisse.ch and let us know their request. Once the notional hourly rates have been approved, the institution will be added to the application portal.

The new research institution submits the documents listed in the factsheet for non-commercial research centres outside academia in parallel with the funding application.

Budget and costs of the research partner

In the application platform, personnel costs are calculated on the basis of the stored notional hourly rates of the respective research institutions. Together with the material costs applied for, these make up the project budget. In addition, there is an overhead contribution (percentage calculation on the project budget). This gives you the funding budget.

Project budget: The project budget is calculated using the calculated notional hourly rates for personnel and material costs in the application and is considered the planned budget for the project. Adding the overheads gives you the funding budget.

Effective costs: The effective costs are the verifiable costs incurred for the project, which must be listed in the final statement of accounts (including the relevant supporting documents). The amount of the final tranche or the amount to be recovered is determined on the basis of the final statement of accounts.

The chargeable direct project costs comprise personnel costs and material costs.

Contributions by Innosuisse are not subject to value-added tax as subsidies in accordance with Art. 18(2)(a) of the VAT Act, but are counted as non-remuneration. On the other hand, the expenses incurred by the research centres for the project (e.g. costs for a machine) are subject to VAT. This means that the research centre’s expenses and financial contribution (cash contribution) must be specified in the application and in the statement of accounts, in each case including VAT.

They comprise salary costs and employer contributions.

Only the function-related expenses for the project are chargeable, i.e. personnel costs for work directly related to and required for the development of the innovation project. The annual expenditure may not exceed the maximum annual gross salaries according to Art. 15(1) of the implementing provisions for innovation projects:

The maximum amounts must be adjusted according to the degree of employment. This means for a degree of employment of 50 per cent, the maximum gross salary must be reduced by 50 per cent, for example.

At the beginning of each calendar year, all research partners receive from Innosuisse a guide, a test certificate and an Excel template. Please consult the guide for details.

The notional hourly rates are calculated roughly using an Excel template as follows: Total annual gross salaries of all employees of the research institution per personnel function divided by full-time equivalents and by the annual productive hours.

For employer contributions, a direct percentage is quoted per personnel function.

If your institution does not yet have approved notional hourly rates, the documents can be requested at supervision@innosuisse.ch. The submitted documents will be reviewed and approved by Grant Surveillance and subsequently stored in the application tool.

The annual hours that may be allocated to the project are based on the internal guidelines of the respective research institution or implementation partner. Among other things, employment law requirements regarding maximum working hours must also be taken into account.

The rule that the salaries claimed may not be funded by other means applies equally to all project staff. The criterion of function or temporary or permanent employment is not decisive.

No personnel costs can be claimed for project staff whose employment is already fully funded by the public sector or other third-party funding. It is the responsibility of the respective research partner to provide proof that this is not the case for professors in a specific funding application.

No, Innosuisse does not recognise such payments as the relevant salary components of the project partners for project funding.

The hours must be entered based on the employee’s personnel function and his/her salary costs in the research institution and not according to his/her function in the project. The classification should be identical as for the calculation of notional hourly rates. If the hourly rate of the salary category differs greatly from the real hourly rate, Innosuisse allows a classification into the next higher or lower salary category. However, the research centre must be able to justify and demonstrate the deviation upon request. If in doubt, please contact your institution’s Grants Office.

Material costs are chargeable if they are necessary for the realisation of the project, do not concern the basic equipment of a research institution and are not compensated by the financial contribution of the implementation partner. This may include, for example, the costs of apparatus, consumables and licenses, third-party services and international travel. Please b article 18(2) of the implementing provisions for innovation projects regulated:

The utilisation of project results, in particular for publications on research results, for the marketing of project results and for the registration of industrial property rights, is not chargeable. All expenses incurred within Switzerland (e.g. meals and travel) are also not chargeable.

The costs for research infrastructure applied for must be necessary for the implementation of the project and may not be part of the research institution’s basic equipment. Chargeable depreciation rates are those determined in accordance with the institution’s internal accounting rules over the lifetime of the project.

If the infrastructure (including existing infrastructure) is not used exclusively for an Innosuisse project, the actual share of use in the project can be charged. The share of use must be duly verifiable (e.g. through laboratory notebooks) and auditable.

The costs of consumables that are necessary for the implementation of the project and that have been purchased during the lifetime of the project and are not part of the research institution’s standard equipment are chargeable. The project reference must be documented in a comprehensible way (e.g. with a purchase receipt).

Basically, the work in a project is performed by the project parties.

The involvement of third parties must be justified and necessary. This may include purchasing services from third parties, for example, for computing time and cloud computing or blood draws from patients. If a foreign research institution has to be contracted for individual tasks, these costs can be requested as third-party services.

Travel costs are chargeable if they are absolutely necessary for the implementation of the project, in particular in the case of projects involving travel outside Switzerland. Travel expenses for conferences abroad are only chargeable if participation is necessary and directly related to the project and the partner makes an active contribution to the conference (presentation, poster, lecture and booth). Participation purely as a visitor to a conference will not be covered. Other chargeable costs related to travel include taking samples abroad or experiments that must be performed abroad. Travel expenses within Switzerland are not reimbursed.

For the reimbursement of meals, the flat rates pursuant to Article 43 of the FDF’s Ordinance of 6 December 2001 on the Federal Personnel Ordinance (FPersO) will apply mutatis mutandis and the usual, reasonable, actual local expenses will apply to travel and overnight stays; a maximum amount of CHF 300 will apply to overnight stays.

The equipment and facilities that are part of the research centre’s basic equipment and usual operations and are standard cannot be procured at Innosuisse’s expense. No usage costs can be claimed for them either.

Basic equipment includes apparatus, materials and other equipment components that are part of the standard equipment of a research centre with a comparable research purpose. This includes, for example, the standard IT equipment including hardware and software or, in a clinical setting, disposable gloves and syringes. However, if a piece of software is directly related to the project and is indispensable for the realisation of the project, its costs can be claimed.

Innosuisse pays overhead contributions to all research partners that are entitled to contributions.

Overhead contributions serve to partially compensate the research institutions for the indirect costs incurred by them as a result of research projects that Innosuisse supports within the scope of its project funding.

The overhead contribution is now measured as a percentage of the total Innosuisse project budget (personnel costs plus material costs).

Parliament sets the maximum flat-rate payment. For the 2021-2024 financial period, this is 15 per cent, and 25 per cent for technology competence centres.

Innosuisse will determine the applicable percentage within the limits of the funds available each year. For 2023, Innosuisse is targeting the maximum rate of 15 per cent. For the technology competence centres, the value is determined annually for each technology competence centre.

The overhead contribution is based on the percentage applicable at the time that the application is submitted.

Yes, the percentage of project funding applicable when the application is submitted is valid for the entire duration of the project.

Yes, the overhead contribution is shown separately from the direct project costs in the subsidy contract.

The overhead contribution is paid out together with the contribution tranches for the direct project costs and divided equally in percentage terms.

The subsidy contract or the financial acceptance letter will state the overhead per research centre in the case of projects involving several research centres.

Participation and costs of the implementation partners

Companies and other implementation partners participate with own contributions in the amount of 40 to 60 per cent of the total direct project costs (i.e. excluding the overhead contribution), with at least 5 per cent of the total project cost as a financial contribution (cash contribution) to the research partner.

In certain cases, a lower or higher participation of the implementation partner is possible (see details in Article 19(2) to and 2ter RIPA, SR 420.1)

The implementation partners’ contribution consists of own contributions and financial contributions (cash contribution) to the research partners. The financial contribution is at least 5 per cent of the total project cost.

Financial contributions by the implementation partners to the research partners to cover necessary direct costs incurred by the research partners in the course of project implementation (specifically personnel and material costs) are chargeable for the cash contribution.

The personnel and material costs of the implementation partners, which are necessarily incurred from participation in the project, are counted towards the own contribution.

To measure the personnel costs in the application, the implementation partners use by default the hourly rates specified in Art. 15(2) of the implementing provisions for innovation projects:

The implementation partners have the option to adjust them. In addition, a flat rate of 20 per cent is applied for employer contributions.

Non-personnel costs are charged to the own contribution, provided that they are necessary for the purposeful implementation of the project and correspond to the actual costs, i.e. can be shown in the operating account of the implementation partners.

No, Innosuisse does not recognise these payments as the relevant salary components of the project partners for project funding.

It can participate in and innovation project as implementation partner, provided that relevant added value in Switzerland can be demonstrated. It is important that the work is carried out by the Swiss subsidiary and that the know-how is available there.

Finalising contracts and starting projects

Intellectual property and usage rights agreement

At a minimum, the provisions of Art. 41 of the RIPO (SR 420.11) apply. The project partners are in any case obliged to comply with these regulations when working together. Innosuisse may, however, stipulate that an agreement between the partners going beyond these provisions must be made. Such conditions are required by Innosuisse in the vast majority of approved projects. The project partners must individually negotiate and agree on all arrangements that go beyond the provisions set out in Art. 41 RIPO. Where such a requirement exists, the agreement must be submitted no later than three months after the start of the project.

NOTE: As these negotiations are important and can be complex, Innosuisse advises the project partners to deal with this issue at an early stage and to have already reached at least an agreement in principle on this issue by the time the application process is started.

The project partners must submit the required documents concerning intellectual property rights of use at the latest three months after the start of the project.

If Innosuisse has included such a condition in the subsidy contract, Innosuisse will normally pay out 50 per cent of the promised subsidy funds upon conclusion of the subsidy contract, even if the signed agreement is not yet available. The agreement must be available three months after the start of the innovation project, otherwise the subsidy contract can be terminated by Innosuisse. The detailed provisions are laid down in the subsidy contract.

The minimum content requirements are listed in Art. 41(2) RIPO. The content of any agreement going beyond these provisions will be determined on a case-by-case basis.

Art. 41(3) to (5) RIPO govern the rights that must be granted to the implementation partners as a minimum.

According to the legal requirements, the implementation partners have at least the right to the free, non-exclusive use and commercialisation of the results of the supported innovation project in the area of their goods and services. The details are set out in Art. 41(3) to (5) of RIPO.

Project reporting

Project reporting and requesting changes to your innovation project

Financial interim reports only have to be submitted if expressly requested by Innosuisse.

The implementation partner must complete and sign the «Contributions by the implementation partner» Excel document. The cover sheet and the second tab «Calculation of personnel costs» must be submitted.

The implementation partners’ contribution is based on the project budget set out in the subsidy contract and therefore remains unchanged in terms of the amount.

If the implementation partners do not contribute to the extent defined in the subsidy contract without providing adequate reasons/justification, Innosuisse’s funding may also be reduced accordingly.

Conclude project

Concluding your project

No additional documents (evidence/records) have to be submitted with the final financial report. Confirmation by signature is sufficient. However, the evidence must be made available upon request.

Yes, the final financial report must be signed by both project partners. Digital documents must be signed using electronic signatures. Details on electronic signatures can be found here.

The implementation partner must complete and sign the «Contributions by the implementation partner» Excel document. The cover sheet and the second tab «Calculation of personnel costs» must be submitted.

The implementation partners’ contribution is based on the project budget set out in the subsidy contract and therefore remains unchanged in terms of the amount.

If the implementation partners do not contribute to the extent defined in the subsidy contract without providing adequate reasons/justification, Innosuisse’s funding may also be reduced accordingly, and where necessary funding that has already been granted may be claimed back.

Innovation Cheque

Submit application

Prepare and submit an application

Every enterprise operating in Switzerland receives a unique enterprise identification number (UID). To ensure that numbers are correctly assigned, managed and used, the UID register is run by the Federal Statistical Office (FSO). The UID register can be accessed via the following online address:

www.uid.admin.chThe application has to be submitted by the implementation partner.

All research partners listed in the overview of research centres with approved innovation projects are entitled to execute innovation cheques:

If your research partner is not named, they must belong to one of the following categories:

- University research centres in accordance with Art. 4 c RIPA

- Non-commercial research centres outside the higher education sector in accordance with Art. 5 RIPA

- Research institutes commissioned by departments of the federal government in accordance with Art. 16 (3) RIPA which carry out their own research projects for the purpose of fulfilling their mandates

- Federal research institutes in accordance with Art. 17 RIPA

Conclude contract and conduct preliminary study

No, the implementation partner must agree on the legal relationship with the research partner.

Conclusion and final reporting

Submit final reports and redeem innovation cheque

No additional documents (evidence/records) have to be submitted with the final financial report. Confirmation by signature is sufficient. However, the evidence must be made available upon request.

No, there are no overhead contributions with the innovation cheques.

The research partner can choose either the notional hourly rates billing method or the gross salary method for the innovation cheque. It is important that the amounts indicated can be proven at Innosuisse’s request. This must first be discussed internally with the institution’s finance department.

The hourly rate and employer contribution applicable are those approved by Innosuisse in the year when the application was submitted. If no notional hourly rates for the relevant year have been approved when the innovation cheque is completed, the hourly rates and the employer contribution of the previous year will apply.

Yes, reallocations can be made without the need for approval by Innosuisse. However, if the total amount of material costs exceeds CHF 7,500, written consent must be obtained from Innosuisse.

The amount is made up of the total chargeable personnel costs and material costs including the stated VAT rate of the research institution.

The amount is automatically transferred to the research partner after the 30-day appeal period has expired and after receipt of the final statements of account. It is not necessary to send an invoice to Innosuisse.

Yes, a one-off extension of six months can be requested by e-mail to innocheque@innosuisse.ch, indicating the reasons why an extension is required.

Yes, a budget increase can be requested in writing by e-mail to innocheque@innosuisse.ch if the awarded grant is less than 15,000 Swiss francs.

No, a company can receive a voucher for a preliminary study at most every two years.

International projects

Eurostars

Questions about Eurostars

Eligible costs include:

- effective personnel costs up to the following maxima of the gross salary:

- Project coordinator and his/her deputy; experienced researcher: Maximum of CHF 220,500 gross per year or CHF 119 per hour;

Research assistant, scientific collaborator: CHF 126,000 gross per year or CHF 68 francs per hour;

Technician, programmemr: CHF 113,400 Swiss francs per year gross or CHF 61 per hour;

PhD student and assistant: CHF 85,100 gross per year or CHF 46 per hour,

- Project coordinator and his/her deputy; experienced researcher: Maximum of CHF 220,500 gross per year or CHF 119 per hour;

- Depreciation costs of equipment and installations,

- Consumables,

- Travel expenses abroad,

- Subcontracts to third parties are eligible if they are not placed between the project partners,

- Overhead costs of 15% on all eligible costs.

- effective personnel costs up to the following maxima of the gross salary:

Each Swiss partner must carry a part of their project financing through their in-kind contribution. Companies must demonstrate their capacity to provide their own contributions by means of an audit report, a confirmed investment or by providing evidence of other sources of funding. Universities and research institutions may claim their own contributions in the form of resources covered by basic funding. In-kind contributions may include all eligible costs.

A small and medium-sized organisation (up to 250 full-time equivalents) can apply for support from an innovation mentor at Innosuisse.

The basis for issuing the funding agreement is the listing of all project costs in a financial plan. This budget is more detailed than the cost summary in your application and sets out the eligible costs of the Swiss partners in a binding way. It serves as a reference for the settlement of accrued project costs.

The financial plan will be negotiated between the Swiss project partners and Innosuisse until all open questions have been clarified and the financing by Innosuisse, the EU and the partners themselves has been agreed. Based on the agreed financial plan, Innosuisse will issue the funding agreement. The funding agreement will only come into force when signed by all parties and is a prerequisite for the payment of the funding contributions.

Innosuisse will conduct a first partial payment of the funding amount in the form of an advance payment as soon as the consortium agreement and the funding agreement have been signed by all project partners. Your project can start at the earliest from the start date agreed in the consortium agreement and only after all parties have signed.

The project costs will be counted as eligible costs from the start date agreed in the consortium agreement, even if no signed funding agreement has yet been received.

Start-up Coaching

About the coaching programme and applications

Questions about Initial Coaching

The Innosuisse coaching vouchers are limited for use with the coaching options offered and cannot be paid out.

Yes. Successful completion of the Initial Coaching by Innosuisse is a prerequisite for application to the Core Coaching programme.

The application cannot be edited once it is submitted. Additional documents will not be considered for the evaluation after submission.

All Innosuisse coaches have a proven track record of their expertise. Further information on the individual coaches is provided in the Innosuisse application platform. Extensive interviewing is therefore not expedient. However, it is recommended you contact and briefly discuss the match with a specific coach. Innosuisse can support you with the selection if you are unsure.

The relationship between you and Innosuisse is a funding relationship. The associated rights and obligations are set out in the «decision» you will receive when your application has been approved. A "decision” is a legal term for the paper document that Innosuisse sends to the applicants. This document contains the decision as to whether an application for coaching was approved or rejected.

Your partnership with a coach is governed by a standardised contract, which is implemented in the IT tool and automatically becomes effective as soon as that coach decides to accept your invitation to work together. You will need to specify a portion of your budget to be assigned to each coach for their services. The budget amount is to be agreed between you and the relevant coach directly. If necessary, the budget can be amended at any time in the Innosuisse application platform by mutual agreement.

Under certain circumstances it is possible to change the lead coach. This matter should first be discussed with the lead coach and subsequently requested with Innosuisse by email (startup@innosuisse.ch).

Coaches are paid for their flexible coaching services on an hourly basis at a standard hourly rate. The whole payments process is managed directly and electronically in the Innosuisse application platform.

The voucher is managed solely via the Innosuisse application platform provided by Innosuisse. There you can see which coach(es) you are working with and how much of your budget you have left.

The Innosuisse coaching voucher is only valid for Innosuisse- accredited coaches and cannot be used for coaches outside of the programme.

You can complete the programme at any time but must finish it by the defined end date. In order to complete the coaching programme, you have to submit a specific evaluation report for review using the Innosuisse application platform. You can do this as soon as you are ready to answer the questions in the form, but by no later than the end date of the specific coaching voucher.

No, the portion of the budget that has not be used cannot be paid out.

Yes, both start-up companies (as an overall organisation) and their founders (as individuals) are eligible to submit an application to Innosuisse for Start-up Coaching.

Questions about Core Coaching

The Innosuisse coaching vouchers are limited for use with the coaching options offered and cannot be paid out.

Yes. Successful completion of the Initial Coaching by Innosuisse is a prerequisite for application to the Core Coaching programme.

The application cannot be edited once it is submitted. However, it is possible to send an updated pitch deck by email to startup@innosuisse.ch at the latest three days before the presentation at the Core Coaching Acceptance meeting. Additional documents will not be considered for the evaluation after submission.

All Innosuisse coaches have a proven track record of their expertise. Further information on the individual coaches is provided in the Innosuisse application platform. Extensive interviewing is therefore not expedient. However, it is recommended you contact and briefly discuss the match with a specific coach. Innosuisse can support you with the selection if you are unsure.

The relationship between you and Innosuisse is a funding relationship. The associated rights and obligations are set out in the «decision» you will receive when your application has been approved. A «decision» is a legal term for the paper document that Innosuisse sends to the applicants. This document contains the decision as to whether an application for coaching was approved or rejected.

Your partnership with a coach is governed by a standardised contract, which is implemented in the IT tool and automatically becomes effective as soon as that coach decides to accept your invitation to work together. You will need to specify a portion of your budget to be assigned to each coach for their services. The budget amount is to be agreed between you and the relevant coach directly. If necessary, the budget can be amended at any time in the Innosuisse application platform by mutual agreement.

Under certain circumstances it is possible to change the lead coach. This matter should first be discussed with the lead coach and subsequently requested with Innosuisse by email (startup@innosuisse.ch).

Coaches are paid for their flexible coaching services on an hourly basis at a standard rate (lead coach) or by a lump sum per workshop (special coach). The whole payments process is managed directly and electronically in the Innosuisse application platform.

The voucher is managed solely via the Innosuisse application platform. There you can see which coach(es) you are working with and how much of your budget you have left.

The Innosuisse coaching voucher is only valid for Innosuisse-accredited coaches and cannot be used for coaches outside of the programme.

You will be provided with an official template by Innosuisse that can then be uploaded in the Innosuisse application platform.

The certificate reflects remarkable progress achieved during the Innosuisse Core Coaching programme and it confirms that your start-up is ready for sustainable growth considering various criteria.

Companies with this award get increased publicity, are more attractive to potential investors and improve their access to additional events, initiatives and programmes.

No, the portion of the budget that has not be used cannot be paid out.

Yes, both start-up companies (as an overall organisation) and their founders (as individuals) are eligible to submit an application to Innosuisse for Start-up Coaching.

Questions about Scale-up Coaching

The Innosuisse coaching vouchers are limited for use with the coaching options offered and cannot be paid out.

No, Innosuisse Certification is not a requirement to be eligible for the Scale-up Coaching.

All Innosuisse coaches have a proven track record of their expertise. Further information on the individual coaches is provided in the Innosuisse application platform. The information provided there is sufficient to make a selection. Innosuisse can support you with the selection if you are unsure.

The relationship between you and Innosuisse is a funding relationship. The associated rights and obligations are set out in the «decision» you will receive when your application has been approved. A «decision» is a legal term for the paper document that Innosuisse sends to the applicants. This document contains the decision as to whether an application for coaching was approved or rejected.

Your partnership with a coach is governed by a standardised contract, which is implemented in the IT tool and automatically becomes effective as soon as that coach decides to accept your invitation to work together. You will need to specify a portion of your budget to be assigned to each coach for their services. The budget amount is to be agreed between you and the relevant coach directly. If necessary, the budget can be amended at any time in the Innosuisse application platform by mutual agreement.

Yes. It is recommended approaching coaches who are relevant for your business challenges. You can approach and select individual coaches using the Innosuisse application platform. Innosuisse can support you with the selection.

Coaches are paid for their flexible coaching services on an hourly basis at a standard rate. The whole payments process is managed directly and electronically in the Innosuisse application platform.

The voucher is managed solely via the Innosuisse application platform provided by Innosuisse. There you can see which coach(es) you are working with and how much of your budget you have left.

The Innosuisse coaching voucher is only valid for Innosuisse-accredited coaches and cannot be used for coaches outside of the programme.

The submitted report/application cannot be edited once it is submitted. However, it is possible to send an updated pitch deck by email to startup@innosuisse.ch at the latest three days before the presentation at the Scale-up Award meeting. Any other additional documents after the submission are not considered for the evaluation.

You will be provided with an official template by Innosuisse that can then be uploaded to the Innosuisse application platform.

No, the portion of the budget that has not be used cannot be paid out.

Application platform Innolink

Submitting an application through the Innolink platform

You can now submit new applications through the Innosuisse application platform (Innolink).

Yes. You need to register again for Innolink when you log in for the first time. Due to Innolink's modern technology, your old Analytics account is not valid on Innolink.

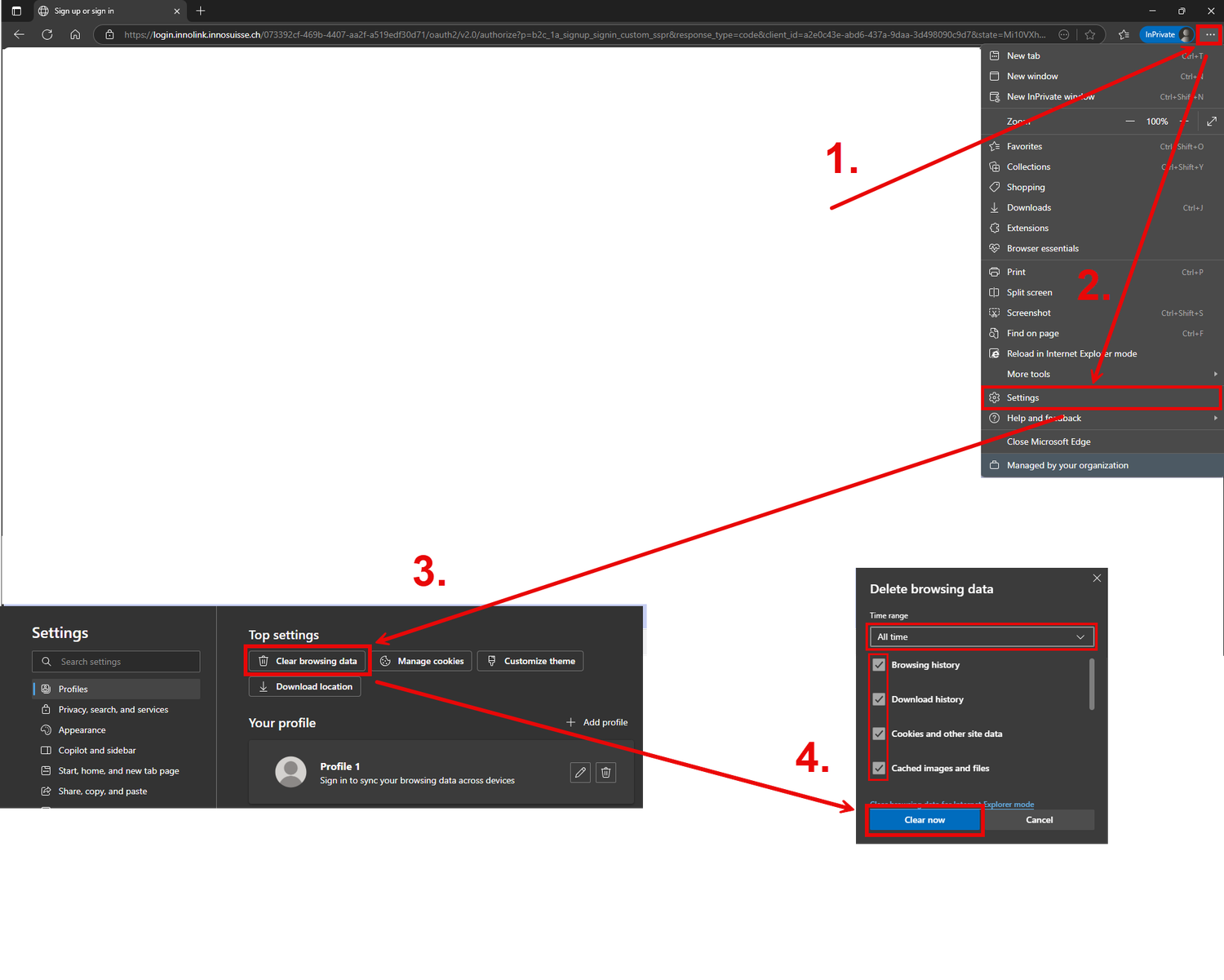

We have received several reports that users are seeing a white screen when accessing the Innolink application. This issue is related to temporary internet files or cookies stored in your browser.

How to fix it:

Option A

1. Open your browser settings,

2. Navigate to the “Clear browsing data” section,

3. Make sure to select “All time” as the time range (the default is often set to “Last hour” – you must change this),

4. Check the boxes for:

- Browsing history,

- Cookies and other site data,

- Cached images and files,

5. Click “Clear now” or “Delete”,

6. Refresh the page.

Option B

You can also use the Innolink website in private browsing mode, which bypasses stored cookies and cache.

Still not working?

If the issue persists after following the steps above, please contact digitalsolutions@innosuisse.ch and we will assist you further.

IncaMail and data protection

Receiving official documents

Click here for step-by-step instructions.

As with letter post, you must collect digital registered mail within seven days. After that, the link will expire and Innosuisse will receive the message that the mail could not be delivered. Please contact us if you can no longer open the link or if you would like to receive it again.

When using our online services, we inform you that communication with Innosuisse is primarily conducted electronically. With the delivery of the invitation-link, we therefore consider our mail to be delivered, and no further delivery attempts will be made in principle.

Please contact us if you can no longer open the link or you would like to receive it again.

Innosuisse is committed to further digitalising its processes to meet the needs of its customers. However, you are free to ask for official items to be delivered by letter post. Innosuisse will then send you the documents again by letter post. Kindly note that this may cause delays.

Secured sending to Innosuisse

Yes. Our e-mail addresses are registered at IncaMail.

General questions IncaMail

According to legal requirements, when official documents (e.g. decisions or provisions) are sent electronically, it must be ensured that the transmission is secure and that the delivery of the transmission can be tracked. For this purpose, public-law organisations such as Innosuisse can use the delivery platform recognised by the federal government (IncaMail).

Innosuisse sends you legal decisions via IncaMail. Innosuisse will also send you documents with confidential content in this way. Kindly note that we reserve the right to reply to regular e-mail messages using regular e-mail as well. We consider the choice of channel used by the sender to be authorisation to use the same channel.

There is no charge for receiving digital registered mail. Depending on the provider, you can also send a certain number of registered items of mail each month free of charge. Please consult the providers’ website:

www.incamail.com

Data protection

In general, we treat everything you share with us with the utmost care and confidentiality: all members of the Secretariat as well as the members of the Innovation Council and the experts are bound by law to official secrecy. An internal code of conduct sets out the obligations to maintain secrecy in concrete terms.

We classify submitted applications and related documents (application documents) as «confidential» in accordance with our internal data and information protection guidelines. We have therefore implemented increased technical and organisational measures, particularly with regard to access and security. This means that application documents in Innolink can only be viewed by a limited group of employees, who are responsible for the respective process step.

In exceptional cases provided for by law, other persons may have access to official files, e.g. the parties as well as the court in appeal cases or third parties in the case of enquiries based on the principle of public access. In the latter case, the files will be blacked out prior to release by Innosuisse in accordance with the FIA (i.e. in principle, no personal data or business and manufacturing secrets will be released).

Details on data processing in Innolink can be found in the terms of use directly in Innolink as well as in our data protection policy.

Organisation and responsibilities

Board of Directors

The Board of Directors is the strategic body of Innosuisse. Its responsibilities are regulated in the SIAA (Art. 7).

In accordance with the SIAA: four years.

The Board Chairman can be re-elected twice.

The members of the Board of Directors can be re-elected once.

Innovation Council

It is the expert body of the future Innosuisse. Its responsibilities are regulated in the SIAA (Art. 10)

The law stipulates at least 15 and at most 25 Innovation Council members.

The Board of Directors wants to constitute a committee of genuine volunteers who spend most of their time working outside Innosuisse in a relevant field. The workload is therefore not expected to exceed 20 per cent.

The members are elected for four years. They can be re-elected once.

Experts

In accordance with Article 10 Paragraph 2 of the Innosuisse Act (SIAA; SR 420.2), the Innovation Council may put forward experts to the Board of Directors for election who are to evaluate applications within its remit and support project work.

The experts cover the full range of projects funded by Innosuisse with their expertise.