Artificial intelligence at the service of finance professionals

With the support of Innosuisse, the Ticino-based SME Cube Finance has developed an intelligent system designed to detect fraudulent banking transactions more efficiently, thereby helping to counteract money laundering. Currently undergoing trials in Ticino, this system aims to provide financial institutions with the means to reduce costs and enhance their compliance strategies.

The banking sector is currently undergoing significant transformation fuelled by increased regulatory demands, budget constraints and the constant requirement for operational efficiency. Against this background, artificial intelligence (AI) is emerging as a lever for innovation and delivering novel solutions to the challenges faced by the financial industry.

Cube Finance, based in Mendrisio, has been developing advanced technological solutions in finance for over 20 years, particularly in areas such as portfolio management, risk management and compliance. Five years ago, company CEO Stefano Zanchetta foresaw a major turning point and seized the opportunity to invest in machine learning models to support the banking sector. «In a highly competitive and ever-evolving industry, AI is not merely an efficiency tool – it has become a strategic lever. AI enables financial institutions to automate decision-making, enhance risk management and achieve unprecedented levels of process optimisation,» explains Stefano Zanchetta.

Innovative approach to anti-money-laundering compliance

With the support of Innosuisse, Cube Finance has developed an innovative AI solution aimed at combating money laundering, specifically designed to monitor banking transactions by evaluating their plausibility within a given context.

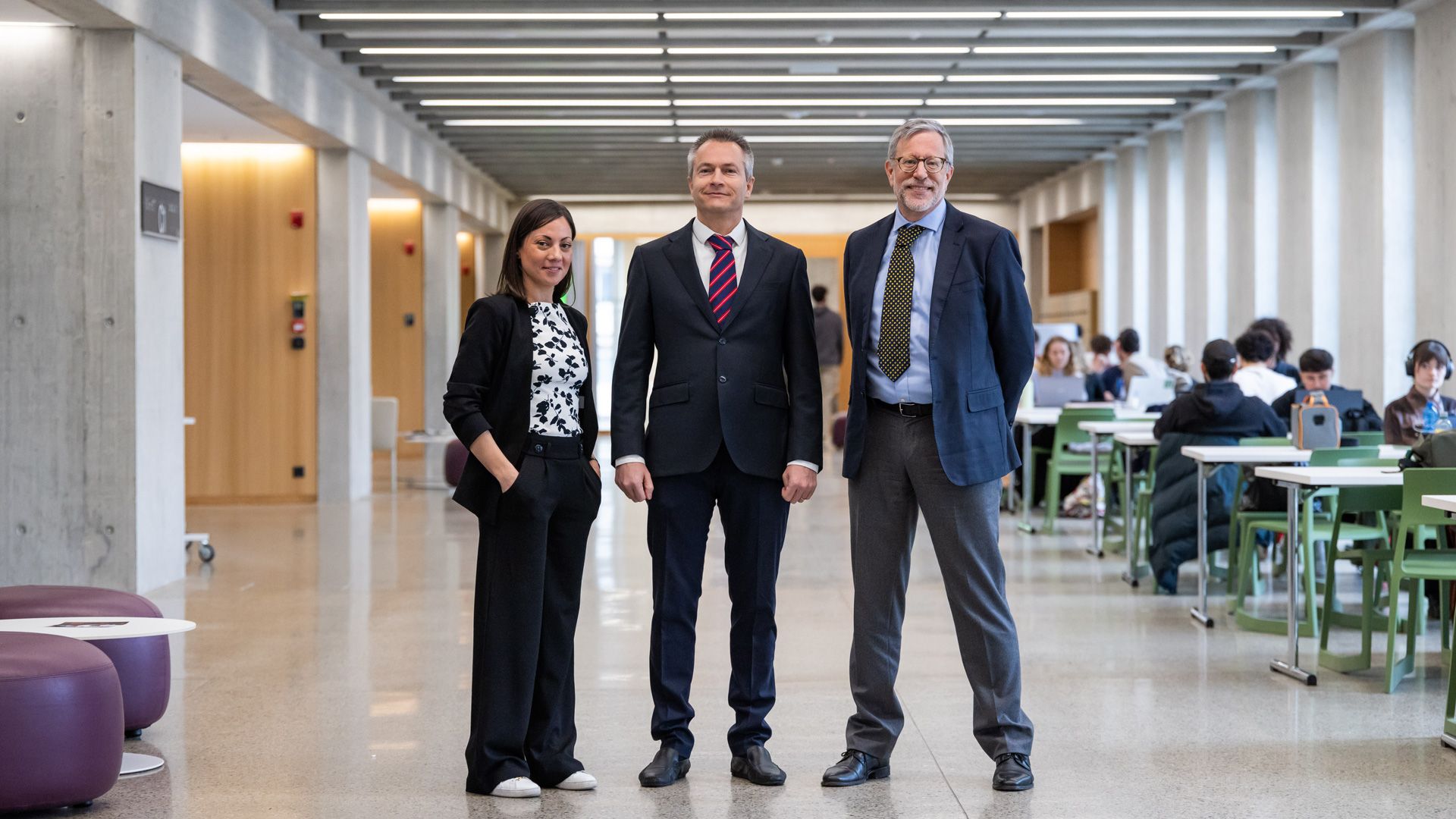

Dubbed FINVA AML, this technology was developed in partnership with SUPSI and the company QBT. Unlike traditional, often rigid systems, FINVA AML functions as an intelligent assistant, intended to complement existing risk scoring and transaction monitoring systems. «This system helps reduce false positives, i.e. legitimate transactions incorrectly flagged as fraudulent,» notes Paul Weber, Head of Business Development at Cube Finance. «By streamlining compliance workflows, FINVA AML enables financial institutions to allocate resources more effectively by focusing on real risks.»

Collaboration was instrumental in the development of this technology. «The FINVA AML solution is the result of a strong partnership where each participant contributed their specialised and heterogeneous knowledge. SUPSI, with its expertise in Data Engineering and Data Science, provided a key contribution for the integration of innovative AI-based methodologies and the achievement of high-quality outcomes. From the outset, a structured roadmap was established to ensure optimal alignment with the project’s objectives and stakeholder expectations,» explains Michela Papandrea, senior lecturer and researcher at the Institute of Information Systems and Networking (ISIN) at SUPSI.

Impact of Innosuisse’s funding

Cube Finance’s technology is currently being tested across several banks in Ticino. «Initial feedback has been very positive. Institutions acknowledge its capability to minimise false positives and enhance compliance workflows, all while integrating seamlessly with existing banking systems,» shares Stefano Zanchetta.

Innosuisse’s funding has been crucial in the SME’s development. «The support from Innosuisse has motivated us to implement significant internal changes, positioning AI as the primary engine of our growth. We have made substantial investments in enhancing our technological capabilities, fortifying our team of programmers and data scientists, as well as our business development team, to ensure the effective execution of our go-to-market strategy,» explains the CEO. He adds: «Innosuisse’s funding has facilitated our market entry, enabling us to forge strategic connections with financial institutions and further bolster our leadership in the area of AI-based compliance automation.»